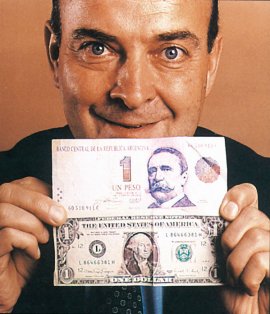

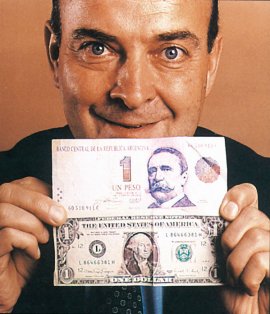

Argentine Economy Minister Domingo Cavallo

Editor's Page

Back in 1990 the Argentine government instituted “convertibility”, according to which the Argentine peso was equal in value to the US dollar – by law, and therefore would, theoretically at least, be convertible in the world at large, just like the dollar. The main reason for this was the fact that Argentina had been plagued by hyper-inflationary waves for many decades, the result of massive government spending via the monetary printing press with nothing to back up all those pesos flooding the market. Ergo, if the peso were always equal to the dollar, to the extent that if you held a peso you could freely exchange it for a dollar, there would be no inflation and Argentina would enter the first-world club with a swish of the magic money-wand.

In order to make this promise, the Argentine treasury would of course have to possess the same amount of dollars in reserve as there were pesos in the market. Easy. They sold off (privatized) all the state-owned properties: the national airline, the railroads, the post office, telephones, even, eventually, the social security system - all money losing enterprises anyway.

It was just about this time that I received a call from my boss in Geneva informing me that I was to be transferred to Montreal or, if that was truly unbearable, to Geneva, with a salary increase. Anyone living in Argentina at that time would think that I should have thrown my hat in the air and cried for joy. But I did not.

Actually I had personal reasons for wanting to stay in Argentina and I had a wild card up my sleeve: early retirement. It would reduce the amount of my pension considerably and would therefore be unthinkable in the U.S. or Europe, but in Argentina, mostly because of the favorable exchange rate, it was a reasonable option even though the exchange rate was not at all favorable at that moment. Still, I was an old expatriate hand in Argentina and had seen many attempts at monetary stability, all of which failed. So I was confident that the present attempt – the one-to-one peso-dollar exchange rate, a.k.a. convertibility, would also fail, and soon.

It failed alright, and miserably, but it took twelve years! It took that long to destroy the Argentine economy. At the beginning it seemed to be working, mostly because there was little of no inflation, but also because privatization worked in some important areas. Telephones, for example, began to work once the spidery webs of cables that till then had covered the sky of Buenos Aires and other cities were removed and relegated to the underground where they belong. The multimillion dollar deficit railroads were shut down because no one wanted to buy them; the subways and suburban lines were sold though, and prospered...temporarily.

It all meant, however, that I couldn't depend on my US dollar pension and would actually have to work, which I did as an organization development consultant. I'll relate two examples to give you an idea of what eventually happened.

Client 1 – a manufacturer of industrial gas heaters. A typical family business founded by the father of its present owners, one brother an engineer and the other a business administration major. Among other things, I instituted a Japanese style quality circle for the workers in order to stimulate motivation. One day the brothers called me in for an urgent meeting. It turned out that although sales were good the company was losing money because of high costs, lack of bank credit and competition from an Italian company. The Italian imported product was sold at the same price as our locally produced one, but of better quality and more efficient. The only advantage my client had was a list of clients and a sales and service organization. The Italian company was offering them exclusive sales and servicing rights for the imported article – but they would have to stop production of their own product. They wanted my opinion.

In reality they didn't need my opinion because the correct option was so obvious. They had to accept the Italian offer or go under sooner or later. At the same exchange rate no Argentine company could compete with North American, European or Japanese organizations. The dollar was the Argentine Euro. They wanted me to tell them to go with the Italians in order to assuage their consciences for having to fire about forty skilled workers. They would retain only the sales staff and a half a dozen skilled workers for the service sector – and themselves of course. I just shook my head and said “no comment” and added that I wouldn't bill them for the non-advice.

Client 2: The company was the country's leading adhesives producer. Sales very good, but there was no bank credit to buy raw materials, high costs, etc. The company was bought by Procter & Gamble, the owners – again two brothers – were retained as managers and the credit problem was thus solved. They considered themselves lucky to have been bought, for the alternative was bankruptcy, or moving to Brazil.

Argentina still had external debts to pay and it needed to keep borrowing money. The fixed exchange rate made imports cheap, producing a constant flight of dollars away from the country and a progressive loss of Argentina's industrial infrastructure which led to an increase in unemployment. But the International Monetary Fund continued to encourage the Finance Minister, Domingo Cavallo who, after the debacle, escaped to the U.S. where he is a Professor of economics at some university. If he ever advises you, do the opposite if you want to keep your shirt.

By 1998 the country was in deep recession, and the IMF recommended the same austerity policies currently being imposed on Greece – as well as Ireland, Portugal and Spain. But the result was that the recession turned into a depression, flight of capital and a run on bank deposits...until the government (Cavallo) simply forbade withdrawals – the infamous “corralito”, ruining a lot of people. In 2002 Argentina defaulted on its enormous public and private debts. The government fell and chaos reigned: Argentina had four different presidents in one week – really!

There followed immediately a 300% devaluation of the national currency. It was like relief from constipation. Argentina was again competitive and its economy began to grow and didn't stop growing until the current world-wide economic crisis which, however, did not hit Argentina nearly as hard as it did the U.S. and Europe.

This is all relative of course. About forty per cent of the population still lives in poverty – at least down from the previous 70% – crime is rampant in the large cities and corruption is, as usual, also rampant. Nevertheless, macro-economically, Argentina survived very well, thank you. They even paid off the IMF debt. Private creditors in the Club of Rome are still seething though.

Countries like Greece were sucked into the Euro zone by the big players, especially Germany and France, abetted by their own fantastic ambition, ignorance and, perhaps, corruption. Who benefits by Greece, Spain, Portugal having the same currency as Germany? Figure it out. Before the Euro, those countries had a distinct exchange rate advantage, and could be flexible about it. Now they are trapped in an iron mask – the Euro, Germany's currency – with no room to maneuver. Just like when Argentina was trapped in the iron mask of the U.S. dollar. Economically Argentina could not and can not compete with the United States, and Greece can not compete economically with Germany. Who benefits with the Euro? Germany, Holland, France – the central European powers over the southern European countries.

They talk about rescuing the “soft” countries: Greece, Ireland, Portugal, Spain... Paula Gil, a 27 year old Portuguese woman, told a Der Spiegel reporter that she, and many like her, feel her country is not being rescued, but taken over – by a foreign power. “We don't get help, we get credit,” she said softly. “But does one resolve debt by becoming even more indebted?” Portugal and its future are now influenced by people who were never elected – the IMF, rating agencies. Or Angela Merkel, a German chancellor.

She is right of course. No one is interested in rescuing Portugal, or Greece. They are, however, very interested in rescuing their own banks, who hold an enormous quantity of “soft” bonds. And, of course, the euro itself is to be rescued for their own salvation.

What must happen? Greece should face the facts and enter default – then throw the Euro overboard and resuscitate the beloved, generous, historical, flexible drachma at a reasonable exchange rate – four to one, say. Just like the present Argentine peso - U.S. dollar relation. Then sit back in the Ionian sunshine and watch the euro/dollar bearing tourists return to their beautiful land in sun-starved hoards. This is not a blow at Europe, as the propaganda claims. The European Union is fine; only a common currency for completely disparate economies and cultures in not sustainable. Now that it's been tried, we know that, so it's time to back out while it's still possible.

For an account of my alter-ego's adventures during the "convertibility" (one-to-one exchange rate) era, see: It's the Exchange Rate, Stupid.

Home